In America and abroad we are being hit hard by rising fuel prices. Not only are these fuel prices painful for individual consumers driving to school or work, but they are affecting many other areas of the economy, such as shipping costs, which are driving up other costs such as food, in a vicious cycle. These rising costs are ultimately passed on to consumers, leading to higher overall prices and increasingly difficult economic times. As any American consumer knows, when prices go up, it is rare that they come back down (unless you are JC Penny with Ellen DeGenerous as your spokesperson – see funny commercial).

A call to action for consumers not to buy gas on April 15, 2012 with the goal of decreasing fuel price.

As long as I can remember consumers have been complaining about the rising price of gasoline. In fact, every year since 1999, there has been an annual movement to have “gas out” fuel boycott, during which everyone is encouraged to refrain from buying gas. Consumers advocating this boycott assert that boycotting will hurt the oil industry financially and coerce them into lowering fuel prices. The most recent call for one of these “gas outs” is planned for April 15, 2012. However, this raises an interesting question: does not buying gas for one day, without decreasing overall consumption of oil, hurt the oil industry? Is this an effective method of protest? See what Snopes has to say about it.

Before answering this question, let us consider some facts.

- Gas (oil) prices are a combination of the price of crude oil (72%), taxes (28%) and futures speculation (±15%).

- Distribution and taxes are relatively stable so the price of gas is more-or-less determined by crude oil price fluctuations and commodities traders (who buy and sell futures contracts).

- The majority of our energy now comes from North America, not the Middle East. In fact, we export more energy than we import. Although war and political unrest do not help oil prices, they do not have the impact they did a few years.

- The declining value of the US Dollar relative to other currencies puts upward pressure on the price of oil.

- Oil supply has increased, demand has decreased and prices continue to increase. Again, this is caused by futures speculation. Investors who used to invest in real estate are now investing in oil futures, which artificially drive up the price of oil.

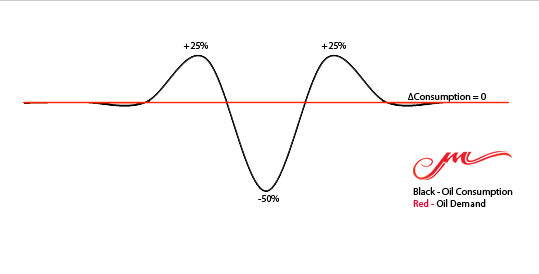

A graph illustrating that a one day "gas out" boycott of gas will have no effect on the net demand (or revenue) from fuel purchases.

And now on to the big question: will a one day “gas out” boycott have any effect on the price oil? I do not believe that it will. Holding a one day “gas out” without decreasing consumption (demand) of fuel will have no effect on price. Let us consider that the “gas out” was to accomplish a 50% decline in fuel purchased on April 15 (see the valley in the handy graph I have created). Now let us consider that consumers purchase 25% MORE fuel on April 14 (see first peak on graph) and 25% MORE fuel on April 16 (see second peak on graph). The net effect is that there is no change in the consumption (demand) of fuel (see the read line on graph).

A boycott of one brand of gas could actually increase prices, since there would be fewer gas outlets. Those companies that were boycotted would simply sell their gas to those that weren’t boycotted, defeating the purpose.

To explain my opinion, let us consider some basic laws of economic:

- When there is more supply than demand, prices should decline. Alternately, when there is more demand than supply, prices should increase.

- When there is increasing supply and decreasing demand, prices should significantly decline.

What can be done about it that will actually make a difference?

- Decrease consumption of oil. Drive less, walk more. Carpool to work. Take public transportation. Ride your bike.

- Buy fuel efficient compact cars, hybrids and motocycles. Not SUVs, trucks or luxury vehicles.

- Keep car/vehicle tires inflated fully.

- Invest in “green energy” and alternative fuels. There is nothing good about oil. It is not good for our earth, it is not good for us and attaining it is dangerous. Oil spills have damaged our waterways and there is significant evidence that “fracking” is very bad for the environment as well.

It follows that these methods would decrease the price of oil, but even if they do not lower the price of oil, if we invest in alternative fuels and stop relying on oil, the price will be irrelevant to us.